There has been a growing emphasis on environmental, social, and governance (ESG) considerations across industries; facility management is no exception. More and more businesses recognize the importance of integrating ESG considerations into their operations.

A recent study by Deloitte shows that 89 percent of surveyed experts are integrating ESG considerations into their operations, and 61 percent seek external assurance for their ESG statements. ESG Operations Inc is at the forefront of integrating these considerations into facility management, showcasing leadership in sustainable and responsible operations.

What Are ESG Companies?

ESG companies prioritize ESG operations by incorporating sustainable solutions and innovative technologies into their business models. This includes the management of wastewater systems, public works, and utility operations. These companies, like ESG Operations Inc and Inframark Company, exemplify an unparalleled commitment to sustainability and ethical practices across various sectors, including public works management.

Key Components of ESG Operations

1. Environmental Responsibility

-

-

Wastewater Management: Companies manage wastewater systems efficiently, ensuring the protection of water resources and compliance with environmental standards.

-

Sustainable Solutions: Implementing eco-friendly practices to minimize environmental impact, such as energy-efficient processes and waste reduction.

-

2. Social Responsibility

- Community Engagement: Public works management companies maintain a strong local presence, fostering positive relationships with communities and addressing local needs.

- Employee Well-being: Ensuring fair labor practices, diversity, and inclusion within the workforce to create a supportive and equitable working environment.

3. Governance

- Ethical Leadership: Strong governance structures that uphold transparency, accountability, and ethical decision-making.

- Compliance and Risk Management: Adhering to regulatory requirements and proactively managing risks to ensure sustainable business operations.

What does ESG mean for facility management?

ESG within the FM context requires asking oneself the following questions:

E - Environmental

Does your organization minimize the impact of its activities on nature and its surroundings? Delivering on E requires tackling challenges like waste reduction, energy efficiency, water conservation, emissions reduction, green building design and operations, climate risk mitigation, and biodiversity protection.

S - Social

Does your organization improve its interactions with its workforce and the broader community? Delivering on S requires focusing on occupational health and safety, good occupant health, employee welfare, community engagement and impact, and diversity and inclusion.

G - Governance

Does your organization focus on decision-making processes, report on activities, and ensure ethical behavior? Fulfilling the G component of ESG necessitates ethics and transparency, risk management, and stakeholder engagement.

Reporting on ESG Operations

To effectively communicate your company's ESG performance, comprehensive and transparent reporting is essential. Here are the key steps and components needed for robust ESG reporting:

Define Core Beliefs and Principles

-

-

Clearly articulate your company’s commitment to ESG principles. This should be reflected in your mission statement and core beliefs.

-

Data Collection and Analysis

- Collect data across all areas of ESG operations, including environmental impact, social initiatives, and governance practices. Utilize technologies such as IoT networks and smart devices for real-time data collection.

- Analyze this data to generate actionable insights that support data-driven decisions and continuous improvement.

Set Clear Metrics and Goals

-

-

Establish specific, measurable goals for each aspect of ESG. For instance, set targets for reducing energy consumption and improving waste management.

-

Track progress against these goals using both historical data and real-time data from your operations.

-

Regular Reporting

- Publish regular ESG reports to keep stakeholders informed about your progress and achievements. These reports should include detailed information on environmental performance, social initiatives, and governance practices.

- Use industry standards and frameworks, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), to ensure your reports meet global best practices.

Transparency and Accountability

-

-

Maintain transparency in your reporting by providing clear, accurate, and honest information. This builds trust with stakeholders and demonstrates your company’s commitment to ethical practices.

-

Hold regular reviews and audits to ensure compliance with ESG goals and identify areas for improvement.

-

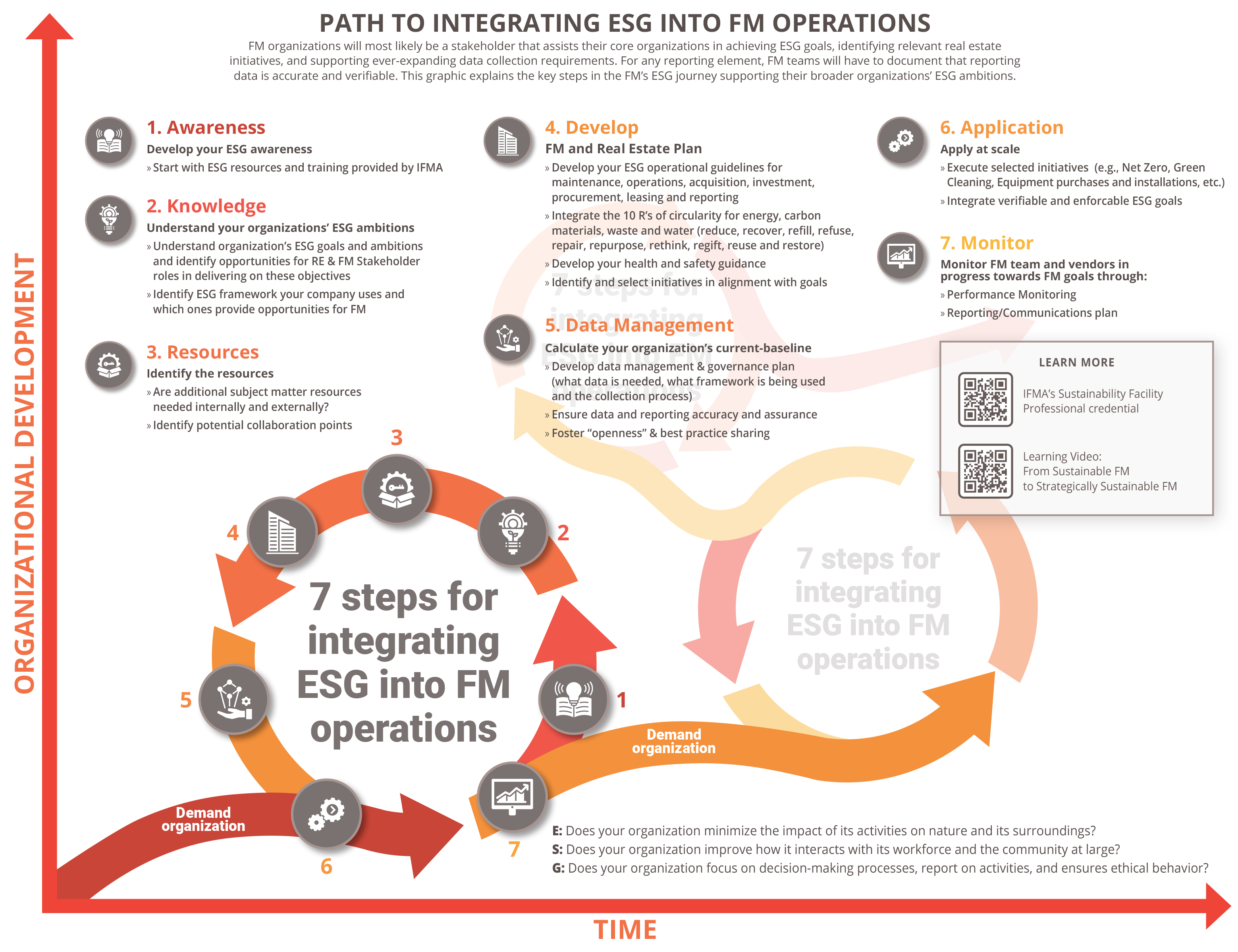

The 7 Steps Model for ESG in Facility Management

To integrate ESG within FM operations and processes, we have proposed the following seven steps:

1. Awareness

Facility managers need to be aware of ESG considerations and their importance. You can start with ESG resources and training IFMA offers, including IFMA's Sustainability Facility Professional certification and educational video on ESG. Facility managers should be familiar with the issues under E, S, & G and how they relate to their organization's operations.

2. Knowledge

Once facility managers are aware of ESG considerations, they need to develop a deeper understanding of their organization's ESG goals and ambitions. FM'ers should identify the ESG framework your company uses and which ones provide opportunities for FM. For inspiration, see IFMA's Building Decarbonization Resources page.

3. Resources

Integrating ESG into FM processes may require additional help from inside or outside the organization, such as technology, training, or personnel. Facility managers should assess what resources are needed and develop a plan for obtaining or collaborating with entities that possess them.

4. Develop

Once facility managers have the necessary knowledge and resources, they can begin developing an ESG strategy within their FM and Real Estate plan for their organization. This may involve setting goals and targets related to ESG factors, identifying key stakeholders, and developing an implementation plan, including communication.

5. Data management

To effectively integrate ESG into FM processes, facility managers need to have access to relevant data and should foster openness and transparency. This may include energy usage data, waste management data, or data related to labor practices. Facility managers should establish systems for collecting, assessing accuracy and assurance, and analyzing this data.

6. Application

Once a plan for integrating ESG into FM processes has been developed, it's time to put it into action at scale through verifiable and enforceable ESG goals. This may involve implementing new technologies, training personnel, or changing operational procedures.

7. Monitor

Finally, facility managers should regularly monitor and evaluate their ESG performance to ensure they meet goals and targets. This may involve conducting regular audits, collecting feedback from stakeholders, or using performance metrics to track progress.

In conclusion, integrating ESG considerations into FM processes is becoming increasingly important for organizations across industries. By following these seven steps, facility managers can develop an effective ESG strategy that aligns with their organization's values and priorities.

Editor's Note: This blog was cowritten by Jeffrey Saunders, Dean Stanberry and Colette Temmink. Jeffrey Saunders is CEO of Nordic Foresight and the Chief Technology Officer for the The National Defence Technology Centre. Dean Stanberry is the former first vice chair of IFMA's Global Board of Directors. Colette Temmink is the EVP at Voxel.

.png?width=352&name=Blog%20Post%20Images%20(13).png)